As a high school student, my daughter has been studying history, government and economics.

Did you know it was illegal for Americans to own gold following the great depression?

If a friend borrowing your house, told you that when you wanted it back they would give you one room instead of the entire house because they had traded the rest of the house for vacations and other things they wanted, you would probably be pretty upset. Your friend didn't keep up his end of the contract and defaulted on the debt to you. There could be multiple reasons for your friend's actions, but the bottom line is that you are out most of a house. Fortunately you were lucky enough to get a room out of the deal.

This may sound quite far fetched, but it is almost exactly what happened in 1971 when the United States was taken off the gold standard. The formal word for being taken off the gold standard is a devaluation of currency. In code, the 1971 devaluation meant the government defaulted on its debts, and instead of owing gold, Americans owned paper. America being taken off the gold standard was a lot like the friend borrowing the house.

Concepts of inflation, deflation, devaluation, depression and recession are difficult to understand when watching and reading about current events in the media. The media has us so confused that we think there is no way we could ever understand these concepts. The reason is they are not pure economic concepts we are trying to understand. They are economic concepts mixed with government policy. The government regulation of currency makes it behave in an unpredictable manner which even financial analysts have difficulty understanding.

This correlation of government, economics and history is a subject my husband and I have been working to understand and find resources to teach the concepts to our children. Fortunately, there are resources available that can help untangle the confusion.

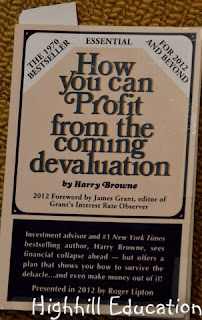

The book How to Profit from the Coming Devaluation is an economics book first published in 1970. The author, Harry Browne, predicted the devaluation of 1971 and the following recession. Not being an economics scholar, I loved this book because it explained how the government's involvement effects conditions we see and feel in our everyday lives. In addition, it teaches how to prepare for a recession before it happens.

My husband, daughter and myself enjoyed reading this book and now feel we have a much better understanding of how governments use inflation, deflation and devaluation to control the money supply. We all know that money doesn't grow on trees, but sometimes it seems like the government believes it does. With skyrocketing national debt we wonder how and when this will all end. How to Profit from the Coming Devaluation is a simple book to read that really helped me to gain valuable knowledge and prepare for the future.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.